Understanding Customer Behavior to Enhance Delinquency Control

Effective delinquency control begins with a deep understanding of customer behavior. Organizations often focus on policies, payment systems, and reminders, but the most significant insights come from analyzing how and why customers pay late. Understanding behavior patterns, motivations, and challenges allows businesses to develop targeted strategies that address the root causes of delinquencies. Companies that invest in behavior-based insights not only reduce overdue accounts but also improve customer satisfaction, strengthen relationships, and enhance financial performance.

Integrating behavioral insights into delinquency management helps organizations identify risk signals early and tailor interventions accordingly. By combining customer behavior analytics with technology and strategic communication, businesses can create proactive frameworks that prevent delinquencies instead of reacting to them after they occur.

Recognizing Common Behavioral Patterns

Customers rarely become delinquent without showing certain patterns beforehand. Recognizing these signs early is crucial. Common indicators include delayed responses to inquiries, sudden changes in purchase frequency, reduced communication, or partial payments instead of full settlements. These patterns may signal financial strain, dissatisfaction, or simple forgetfulness.

Analyzing past interactions and payment histories helps organizations predict which customers may be at risk in the future. Behavioral patterns allow teams to segment customer groups and assign different levels of follow-up intensity, ensuring more efficient and personalized support.

Identifying Key Motivators Behind Late Payments

Different customers fall behind for different reasons. Understanding these motivations allows organizations to adopt more effective and empathetic strategies. Common motivations include:

- Financial hardship due to loss of income or increased expenses

- Confusion about billing terms or invoice details

- Dissatisfaction with service or product quality

- Overlooked communications due to busy schedules

- Lack of convenient payment options

When organizations address these root causes directly, they improve both payment performance and overall customer experience.

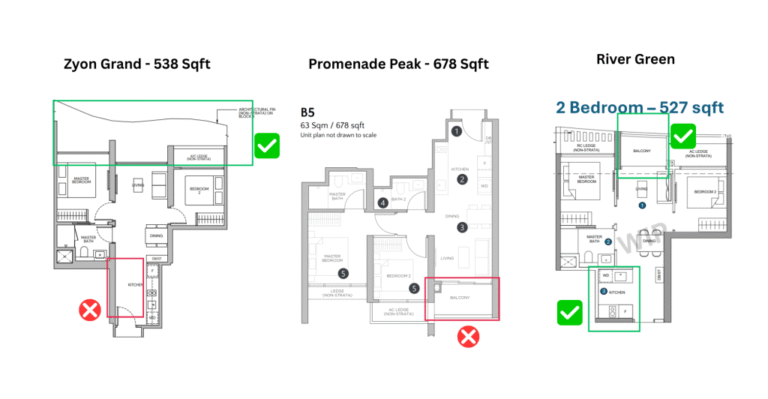

Enhancing Customer Segmentation for Targeted Actions

Customer segmentation is a powerful tool for managing delinquencies. By grouping customers based on behavior, risk level, and communication responsiveness, organizations can tailor their outreach strategy. High-risk customers may need more frequent reminders or personalized payment plans, while low-risk customers may only require standard notifications.

Proper segmentation allows companies to allocate their time and resources more effectively. Instead of treating all customers the same, organizations focus efforts where they are needed most, reducing operational strain while improving results.

Monitoring Communication Engagement Levels

How customers engage with communications can reveal a lot about their future behavior. For example, customers who consistently open emails, respond quickly, and engage with self-service portals are more likely to pay on time. In contrast, those who frequently ignore reminders or show delayed engagement may be at higher risk of delinquency.

Tracking these engagement levels allows organizations to adjust their communication methods. Some customers may respond better to SMS, while others may prefer email or phone calls. Offering communication choices enhances customer satisfaction and increases the likelihood of timely payments.

Using Predictive Analytics to Understand Future Behavior

Predictive analytics tools use past data to predict future actions. For delinquency control, predictive models help identify customers who may become delinquent even before they show clear warning signs. These tools evaluate factors such as payment frequency, account activity, credit history, and communication response patterns.

Organizations can use these predictions to take proactive measures, such as offering flexible payment plans or sending early reminders. This approach reduces the number of overdue accounts and provides support to customers before their situations worsen.

Strengthening Customer Relationships Through Personalized Approaches

Personalized communication is key to effective delinquency control. Customers are more likely to respond positively when the communication feels relevant to them. Personalized messages that reference their payment history, preferred methods of communication, or account details can create a sense of trust and responsibility.

Additionally, offering customized payment options for customers experiencing financial hardship helps maintain relationships while reducing risk. When customers feel understood, they are more likely to stay cooperative and committed to resolving outstanding balances.

Improving Billing Transparency and Accessibility

Many delinquencies occur due to misunderstandings or confusion about billing. Ensuring that invoices are clear, detailed, and easy to understand reduces disputes and delays. Providing access to online portals where customers can review their accounts, update information, and make payments also improves transparency.

Customers appreciate being able to access their financial details whenever needed. This level of control encourages timely payments and reduces the likelihood of unintentional delinquencies.

Supporting Customers Through Education

Educational resources such as guides, FAQs, and onboarding materials can help customers understand expectations and avoid mistakes. When customers clearly understand billing cycles, payment methods, and credit terms, they are less likely to fall behind.

Organizations can offer education through emails, website content, or customer service interactions. Empowered customers make more informed financial decisions and respond better to reminders and follow-ups.

Conclusion

Understanding customer behavior is essential for enhancing delinquency control. By evaluating behavioral patterns, identifying motivators, monitoring engagement, and using predictive analytics, organizations can create proactive strategies that prevent overdue payments. Personalized communication, transparent billing, and customer education further strengthen this approach. When businesses combine behavioral insights with strong operational processes, they build a robust system that reduces financial risk while improving customer satisfaction.